Kensington Capital SPAC closes merger with QuantumScape

QuantumScape Corporation (“QuantumScape“), a leader in the development of state-of-the-art solid-state lithium metal batteries for use in electric vehicles, announced today that has completed its business merger with Kensington Capital Acquisition Corp. (“Kensington”) (NYSE: KCAC), a special purpose acquisition company. The Business Combination was approved by Kensington shareholders at a special meeting held on November 25, 2020. As of November 27, 2020, QuantumScape shares will be traded on the NYSE under the symbol “QS” and their guarantees will be traded on the NYSE under the stock symbol “QS.W”.

Since the company was founded in 2010, QuantumScape has focused exclusively on the development of solid state batteries and the design of a scalable manufacturing process to market its battery technology to the automotive industry.

“Today is a big step in the evolution of our company,” commented Jagdeep Singh, founder and CEO of QuantumScape. “This transaction allows QuantumScape to finance the development and commercialization of our OEM-validated battery technology, as we are eager to do our part in electrifying the automotive powertrain, helping to transform one of the largest industries in the world and promoting a cleaner future for everyone. “

“We are incredibly excited to complete our business combination with QuantumScape and to provide the company with significant capital and automotive guidance to accelerate its business plan. The adoption of electric vehicles has emerged as the global megatrend in the automotive industry, and QuantumScape is now doing well. positioned to become a leading supplier of solid state batteries for this next generation of electric motors. “- said Justin Mirro, Kensington President and CEO

The transaction will result in net revenues of approximately $ 680 million for QuantumScape.

About QuantumScape Corporation

QuantumScape, founded in 2010 in California, is a leader in the development of state-of-the-art solid-state lithium metal batteries for use in electric vehicles. The company’s mission is to revolutionize energy storage to enable a sustainable future.

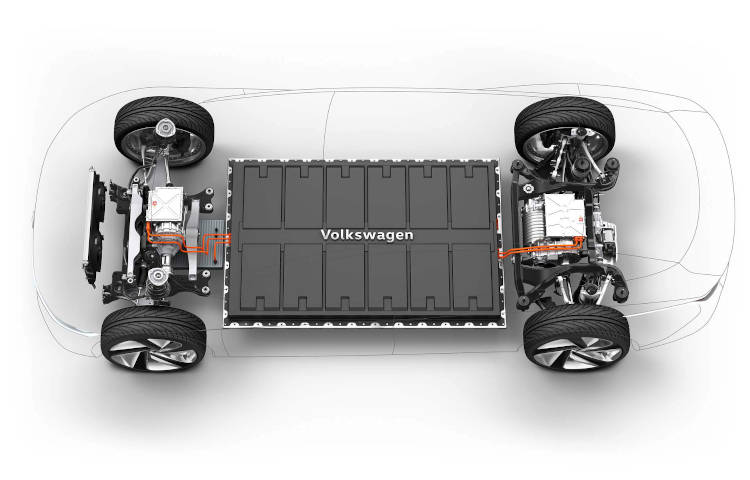

In the decade since the company was founded, QuantumScape has focused exclusively on the development of solid-state batteries and the design of a scalable manufacturing process to market its battery technology to the automotive industry. QuantumScape believes that the proceeds from this transaction will fully finance the company through the start of production through its joint venture with the Volkswagen Group (“Volkswagen”).

One of its first sponsors was none other than Bill Gates , the founder of Microsoft (NASDAQ: MSFT) and one of the richest men in the world.

About Kensington Capital Acquisition Corp.

Kensington Capital Acquisition Corp. (NYSE: KCAC) is a special purpose acquisition company established for the purpose of conducting a business combination in the automotive sector. Kensington is sponsored by Kensington Capital Partners LLC and the management team of Justin Mirro, Bob Remenar, Simon Boag and Daniel Huber. Kensington is also supported by a board of independent directors, including Tom LaSorda, Anders Pettersson, Mitch Quain, Don Runkle and Matt Simoncini. The Kensington team has completed more than 70 automotive transactions and has more than 300 years of combined experience leading some of the largest automotive companies in the world.